Dividends are a highly valuable source of return for investors. Studies have shown that dividend stocks have provided above average returns compared to non-dividend paying stocks over time. In addition, dividends provide a margin of safety: dividend payments help reduce portfolio volatility and provide downside protection. Dividends also force discipline on the part of a company’s management team. When companies have to set aside a portion of earnings each quarter to pay dividends, they are less likely to spend frivolously on wasteful acquisitions.

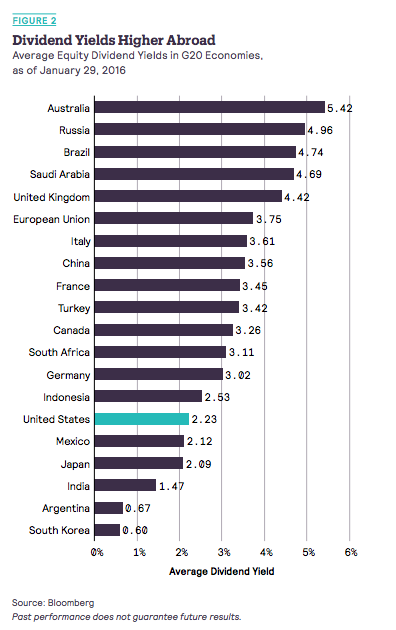

But income investors are in a difficult position today. Due to the continuation of low interest rate policy in the United States, the average dividend yield among US equities is down to 2.2%. This is fairly low, especially for investors who rely on the income generated by their portfolios. The good news is that investors can find much higher dividend yields outside the United States, for those willing to accept the risks of investing in international equities. In fact, in some parts of the world, dividend yields average twice the average yield in the United States, or sometimes even higher.

Comparing and Contrasting the United States and International Dividends

As the above chart illustrates, the average dividend yield in the US stock market is higher than a few markets, including Mexico and Japan. However, there are many more nations with higher dividend yields; the highest average dividend yields are the Australian and Russian stock markets, with dividend yields of 5.4% and 4.9%, respectively.

There are many reasons for this discrepancy. First, the Federal Reserve has kept interest rates historically low in the United States for an extended period. Low interest rates dictate rates and yields across a range of asset classes, including equities. The low rate policy has elevated asset prices. US stock prices have rallied significantly over the past several years, which has suppressed dividend yields since stock prices and dividend yields are inversely related.

Moreover, higher dividend yields in international markets are rational, as the US economy is generally considered to be the strongest economy in the world. Emerging markets are predicted to have higher economic growth than the United States, but they are also more volatile. Among emerging markets, several are in distress, particularly in Russia and Brazil. Their economies are contracting due to the steep downturn in oil and other commodities. As a result, it is reasonable for investors to demand higher yields to compensate them for the elevated level of risk.

Once again the United States dividend yields are lower than most on the list of developed markets, including France with a 3.4% dividend yield and Germany with a 3% average dividend yield. Indeed, there are many risks to investing in international equities. There is standard company risk, which is the risk that an individual company’s fundamentals could deteriorate, but doing so in international markets opens up several additional risks to consider. These include currency risk as well as geopolitical risks. Furthermore, information on foreign companies can be hard to access for US investors.

3 Foreign Stocks with High Dividend Yields

Within the nations listed on the chart that have higher dividend yields than the United States, investors can find several individual stocks that have higher dividend yields than the 2.2% US average. Three in particular are BP plc (BP ), Total (TOT ), and Unilever plc (UL ). BP and Total are both integrated oil and gas companies within the energy sector. BP is based in the United Kingdom and Total is based in France. Based on their current share prices, BP and Total currently yield 7.1% and 5.5%, respectively. Their dividend yields are so high because their share prices have declined, along with the downturn in commodity prices over the past two years. But both companies have committed to cuts in capital expenditures and asset sales in an effort to maintain their dividends.

Meanwhile, Unilever is a consumer staples giant located in Europe. It has a 3.2% current dividend yield. Unilever is a strong company in the consumer staples sector because it has a highly profitable business: its huge portfolio includes a number of popular household products and food products. Some of its portfolio brands include Ben & Jerry’s, Lipton, and Hellman’s. Unilever’s total revenue increased 10% in the last fiscal year. Earnings per share increased at a very strong 14% rate for the year. A major driver of this was 7% revenue growth in the emerging markets.

The Bottom Line

Income investors who may be frustrated by the prevalence of low dividend yields in the United States have a potential solution to this in the form of international stocks. Dividend yields in many parts of the world can be significantly higher than in the United States, but investors should be sure to conduct sufficient research before investing, given the risks of investing in foreign equities.

Check out 5 foreign stocks yielding more than 4.5%